The Digital Home Gets a Fresh Coat of Paint 🎨

After years of neglect, the connected home ecosystem is getting the business equivalent of a fresh coat of paint, new window treatments, and a fix for its leaky roof.

I’ll get to the details of Roku’s potentially neighbood-changing plans to power connected homes, Samsung’s Galaxy S23 smart home compatibility expansion, and signs of progress with Matter smart home standard that’s supported by Amazon, Apple, Google, Samsung, and others.

To me, this spate of connected home activity brings me back to 2018. Expectations were high then. The American home was on the cusp of having all our electronic gear, gadgets, appliances, and entertainment systems seamlessly interacting from bed to kitchen to living room to garage.

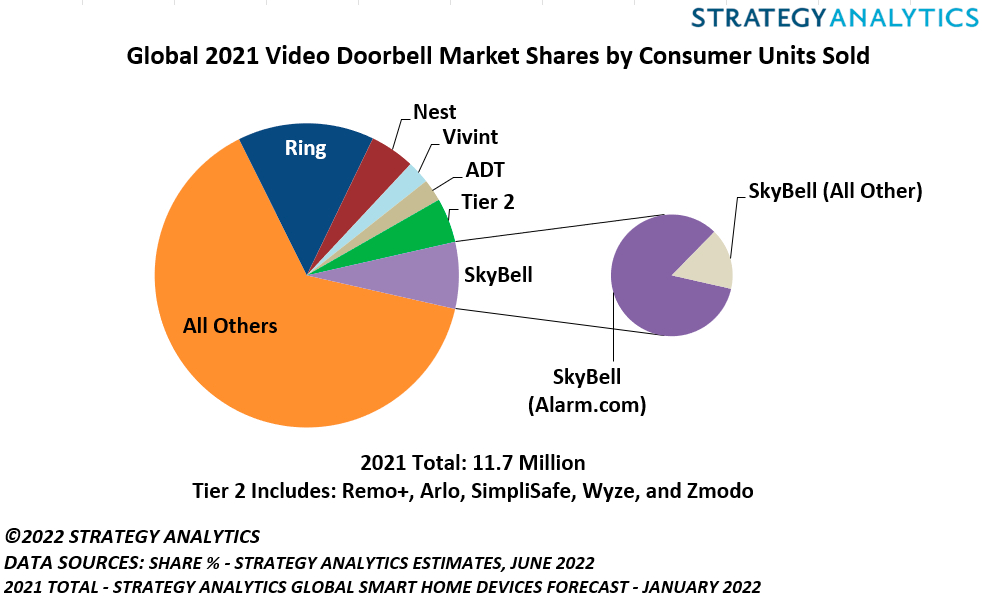

One of the things that’s gotten lost recently is that there were clear success stories in the connected home space. The optimism in 2018-to-2020 was justified by the sales and attention attracted by the likes of Ring, which was purchased by Amazon in April 2018 for $1.2 billion, and has continued to hold a dominant position in the space. Even before Ring, Google acquired “smart thermostat” Nest in 2014 for $3.2 billion and has since made it the hub of its connected home system.

Consider the connected home devices that soared and have become commonplace (and don’t get the attention and wonder they deserve). I’m thinking of Anova Culinary. You may not recall the name, but the company is why, even if you mostly order in, you know what a “sous vide” is.

Anova began as a Kickstarter idea that took up the trendy method of preparing food by placing it inside vacuum-sealed bags for slow cooking it in a temperature-controlled water bath. The company really took off when it added wi-fi that would allow users to cook anywhere they had their smartphone. Anova was eventually acquired by Electrolux for $250 million in Feb. 2017.

Other players such as smart lock August and Anova also helped propel the smart home through 2020, when NPD Group found that 35% of American households owned at least one connected home device.

Brands, investors, startups, content companies had big questions about how these new cross-device communications would impact commerce, advertising, media consumption, and our work/life balances.

So in Aug. 2018, through one of my companies, which was known as the Internet of Things consortium (IoTC) at the time, partnered with Advertising Age to create a “smart home” in Southampton.

IoTC, which has since evolved into the Emerging Tech Exchange, invited companies as diverse as Samsung, Peloton, Google, and Warner Media to plot the connected home future. Porsche ran the smart home’s garage. Samsung managed the kitchen. Sleep Number minded the bedroom.

In Oct. 2019, I hosted an industry event at the Times Center called Internet of Things Consortium NEXT: The Connected Future Summit. The conclusions of a panel session on the connected home could have come from this year, which speaks both to the guests’ prescience as well as to the sluggish pace of the ecosystem.

As for the current state of the smart home market, Global shipments of smart home devices declined for the first time in 2022 as shipments fell 2.6% year over year to 871.8 million units, according to IDC’s March 2023 Worldwide Quarterly Smart Home Device Tracker.

Smart TVs, which represented the largest category, experienced a 4.3% decline in 2022 due to tough year-over-year comparisons as the market for TVs and other products was extremely strong in 2021 due to COVID-related purchasing. Looking ahead, IDC forecasts a modest 2.2% growth in smart home device shipments in 2023 as the global economy recovers. This growth is expected to continue through 2027 with device volumes reaching 1.23 billion in 2027.

The underlying message in those stats is that the smart TV market is saturated. So while Roku needs to find new revenue sources, there are plenty more consumers ready for a better, wider smart home connected experience. In essence, this is the moment when the connected home ecosystem gets back on track.

Open Smart House Season Restarts

The discussions I put together in 2018 and 2019 were so well received, plans were developed to take the smart home show on the road around the country. There would be more events around smart home strategies. Then, 2020 happened.

In the interim, connected TV space began to surge.

CTV ad spending is expected to grow by 13.2% globally in 2023 to $25.9 billion, according to GroupM's mid-year forecast. The WPP media agency forecasts CTV ad revenues will experience an annual compounded growth rate of 10.4% between 2023 and 2028.

Those dollars represent a shift in power to the connected home. And that has propelled Roku in particular to credibly set its sights beyond the living room to encompass the entire connected home.

Anecdotally, this past year has once again seen me asked to provide investment and strategic advice, moderate panels, and host events from CES to SxSW to PTTOW! about the ideas of reopening the connected home were reignited.

Big Tech Plug into the Connected Home

Now, after a period of stalled progress on giving the concept its full potential, Roku, Samsung, and the major tech players may just be giving the connected home a shot in the arm.

As Roku CEO Anthony Wood revealed to Axios’ Sara Fischer this week, the streaming TV player plans to leverage its OTT success in licensing operating systems for smart TVs. Specifically, Roku aims to develop custom operating systems to power connected houses.

Roku has the track record, certainly. The company recognized the significance of building a smart TV operating system early on. In part, that gave the company an early competitive edge as streaming took off. Now, Wood sees a similar opportunity in the smart home sector.

After all, the smart TV is the central entry point to the connected home. But the connected home wasn’t built around the TV. So many smart devices paved the way that Roku is claiming — and Roku will need to prove its value as a stronger connective point for the smart doorbells, locks, and culinary tools that define the connected home.

Consumer interest in connected home devices has grown exponentially, aligning with the prediction.

Meanwhile, some news that could also impact the connected home market went largely unnoticed this past two months. In May, Fortune Brands Innovations, completed its $800 million acquisition of luxury door and cabinet hardware business, Emtek and Schaub, as well as the residential smart locks business of Yale and August (another early success story in the space). The deal deepens Fortune Brands' presence in the connected products sector and expands its offerings in the luxury home products market. A similar wave of M&A activity is almost certain.

For one thing, the deal highlights the value of hardware makers. And that brings us back to Roku.

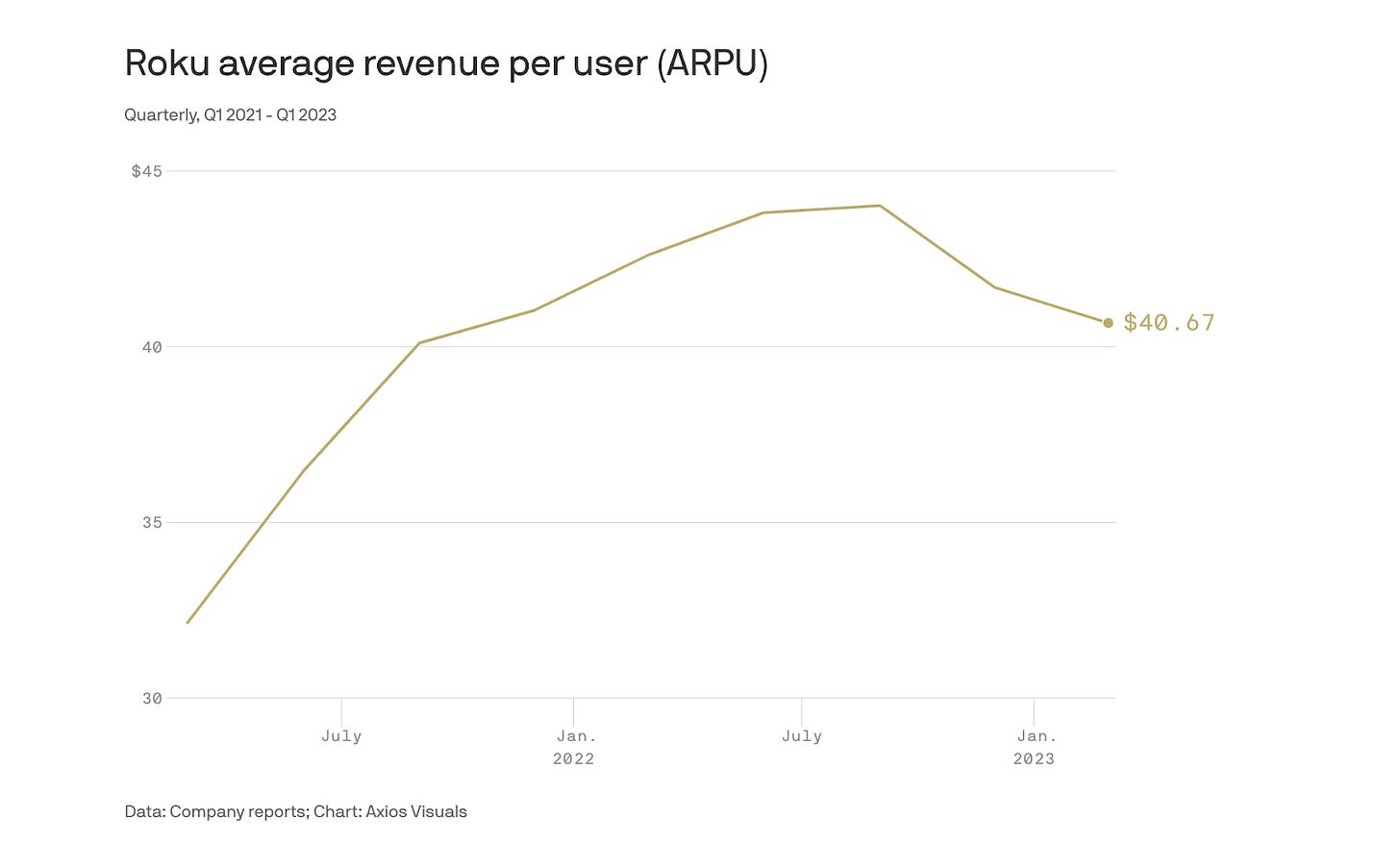

While Roku's hardware products may not be primary profit generators, they play a role in expanding the user base. The company's revenue primarily stems from engaging consumers through its software and earning a share of subscriptions sold to other streamers on its platform.

It's worth noting that Roku's advertising business is also experiencing growth, driven by the popularity of its free ad-supported network, the Roku Channel. The Roku Channel's recent inclusion in Nielsen's streaming measurement survey highlights its increasing impact on total TV watch time.

Looking ahead, Roku's focus lies in developing content "zones" tailored to specific user interests, such as food, through a combination of original and licensed shows. Wood emphasized that mergers and acquisitions are not a central strategy for Roku but rather considered tactically if favorable opportunities arise.

But Roku and Samsung are not alone in building out the smart home. Other major tech players are taking more aggressive action lately.

What’s the “Matter”

About half a year ago, Amazon, Apple, Google, Samsung, and others came together to form “Matter,” which they positioned as “the new smart home standard” that would bring the promised seamlessness of the connected home to fruition. The primary aim of Matter is to simplify the smart home experience by enabling interoperability and ease of use across different platforms and ecosystems.

While the rollout of Matter has been promising, there have been some disappointments.

Since its launch, there haven't been any new device types added. So far, the supported devices mainly consist of plugs, lights, shades, and recently, smart locks. Cross-ecosystem support, a crucial aspect of Matter's promise, still needs improvement.

Despite these challenges, a report in The Verge reminds us that transforming the infrastructure of the smart home is a long-term journey rather than a quick fix. The Matter standard is gradually gaining traction, and major platforms are gradually adopting support for it. However, Amazon lags behind in providing comprehensive support for Matter, again, because it currently only supports a few device types.

The Connectivity Standards Alliance, responsible for managing the Matter standard, has outlined future device types, including home security cameras, robot vacuums, home appliances, garage door controllers, and more, but without specific timing details.

For me personally, the Matter initiative sounds like “deja vu all over again.”

Let’s go back to 2019 once more. In December of that year, Insider asked me to comment on a joint effort to craft standards for smart home interoperability by Amazon, Apple, Google, and the Zigbee Alliance, the governing body of the Zigbee IoT mesh networking standard — which is now called (you guessed it) the Connectivity Standards Alliance.

What I said nearly four years ago could still be said today: “I think the gist of it is that collaboration, we [the IoTC] feel, is not is not a nice-to-have, it's a must-have for the IoT to reach its potential…. The reality is that Amazon and Apple and Google are not great friends, you know, and any sort of statement that says that the three of those in particular … what it does from a signaling on the business end is to say, ‘You're going to have to collaborate across companies and devices, no one company can go at this alone and be successful.’ And I think that, initially, these three companies in particular that were named kind of thought that they could do it on their own, and this is a statement on what can happen, so our feeling [is] that it's going to bring a lot more collaboration in the industry.”

I’m optimistic that the connected home will gain notable traction soon. But it will require the commitment of the connected television industry to jump in with both feet.